You might also like

Brooks Cambium Rubber Grips

Phone holder

Prodrive Folding Bike Carry Bag

Schwalbe Marathon Tire Swap

Spare Single Speed Wheel

Men's Gel Saddle

Women's Gel Saddle

15 September 2022

Benefits of a Cycle to Work Scheme for Employers

If there was a procedure to make employers more productive, your workplace healthier and your business more environmentally friendly, would you pay attention? That's where Cycle to Work schemes come in.

Cycle to Work schemes have benefits aplenty for employees and helps get them on two wheels, but what impact can registering to the schemes have on employers?

Without further ado, let’s dive into the Cycle to Work Scheme employer benefits.

Cycle to Work Scheme Employer Benefits

Save Money on National Insurance Contributions

When an employee orders a bike or cycling equipment through a scheme they pay through a salary sacrifice. Monthly instalments are taken from the employee's salary, reducing their gross pay.

Therefore, you - the employer - reduce your National Insurance contributions by 15.05% of the bike and equipment value, saving you cash.

Improving Staff Fitness, Health and Productivity

Staff who cycle to work are typically fitter than those who commute by other means and are more likely to be productive at work due to increased energy levels.

What do fitter and more productive staff mean? Better job performance, work output and fewer sick days!

Cycling to work every morning can also increase the mental well-being of your employees, and showing that this is something your organisation takes seriously can improve work relations.

Lower Environmental Impact

Corporate social responsibility extends beyond your employees walking through the doors. On average, a commuter who makes a 4-mile round trip to work by car can save 0.5 tonnes of CO2 if they switch to a more sustainable option, a bike.

Promoting eco-friendly methods of transport shows your organisation cares about the well-being of the environment and your employees. This showcases your moral values and ethics, which can improve the public perception of your business whilst lowering your carbon footprint; a win all-round.

Improve Staff Attendance

Physical and mental wellness naturally improves staff attendance at work and can heighten tolerance to stress and self-confidence levels whilst at work.

Also, we are in a time when employers are seeking ways to tempt workers back into the office in an age of working from home. If employees don't have to battle traffic jams or crowded public transport every morning, and they genuinely enjoy their commute, it might tempt staff back into the office.

Reduce Parking and Congestion Issues

Cycle to Work schemes means fewer parking spaces are needed, meaning you could repurpose unused car park space or sell the land if you so wish. Up to 20 bicycles can fit in the same space as one single car, so there is a lot of potentials to reduce your office footprint.

Encouraging staff to cycle to work also reduces pollution and traffic congestion in the local area. All of the above can also save your employer cash on fuel, parking charges, and congestion fees and avoid fees such as London's ULEZ zone.

Capital Expenditure

Bike purchases and cycling equipment can be classified as capital expenditure, enabling employers to claim capital allowances against the purchase cost.

Nothing to Pay: Zero-Cost Implementation

Local authorities hoping to improve the local environment sometimes provide bike sheds free of charge, or at most, at a reduced cost.

Aside from this, schemes are completely free for employers to join and have dedicated support staff and account managers to help coordinate and implement financial arrangements, admin and marketing at zero cost. Therefore, joining a Cycle to Work scheme has zero impact on your business's finances.

Cycle to Work Scheme Savings

Typically, employers can save up to 15.05% in National Insurance Contributions for every employee who purchases a bike through the scheme. To put this into numbers, employers will save £138 for every £1,000 spent on a bicycle or equipment. Over the lease period, you will also fully recover the initial cost of the bike.

You can calculate more precise savings using Cycle Scheme's online savings calculator.

How Do Employers Register with a Scheme?

Registering with a Cycle to Work scheme is simple and easy to manage.

Most schemes operate in a very similar manner, but to enlist with Cyclescheme:

- The employer initially registers with the scheme.

- Access FREE promotional resources to start publicising your new work benefit to employees

- Employees shops for a bike online or at their local bike shop, then they apply on the Cyclescheme website

- Employers review their request and pay the equipment if they are eligible

- The employee receives their bike and the salary sacrifice begins

- 12 months later, the employer has recovered the costs and developed up to 15.05% in National Insurance contributions

All you need to ensure before you begin your cycle scheme endeavour is:

- You pay your workforce through PAYE

- You have the right to enter into a legal agreement on behalf of your business or organisation

- You can pay for the employee's bike (which will be recovered over a 12-month loan period)

Discover how a Cycle to Work scheme works, in more detail.

Hummingbird is proud to work with Cyclescheme, improving the mental and physical well-being of employees and city commuters up and down the country.

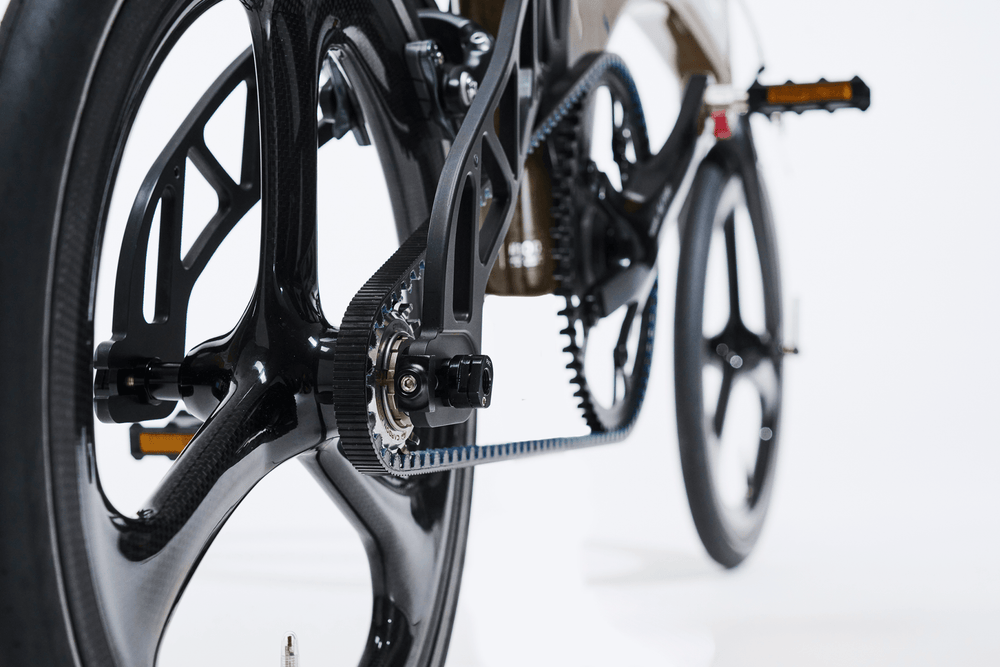

Cyclescheme is one of the UK’s leading schemes, and allows workers to purchase a selection of Hummingbird Bikes, including our lightweight folding bikes, our folding electric bikes and a range of our luxury cycling accessories - so your employees can travel in style

Prodrive Folding

Electric Bike

The ultimate city bike is here.

Latest from

the magazine