You might also like

Brooks Cambium Rubber Grips

Phone holder

Sac de transport pour colibri

Schwalbe Marathon Tire Swap

Spare Single Speed Wheel

Men's Gel Saddle

Women's Gel Saddle

22 August 2022

How Does a Cycle to Work Scheme Work? The Ins and Outs...

Since its inception in 1999, the Cycle to Work scheme has encouraged people to get fitter, reduced vehicle pollution and saved cyclists money on their daily commute.

Approximately 1.6 million commuters from over 40,000 employers have taken advantage of the scheme, and you can, too.

But how does a cycle to work scheme work?

We have covered the ins and outs of the scheme, explaining what it is, how it works, how to see if you qualify and how to purchase your tax-free bike.

What is the Cycle to Work scheme?

Essentially, your employer will purchase a bike which you will then 'hire' through a salary sacrifice. By paying this way and spreading the cost, you will save overall by not paying tax and National Insurance contributions on the monthly fees. The salary sacrifice comes from your gross salary, not your net salary.

Spending tax-free cash on bikes and cycling equipment has saved employees up to 42 per cent on what they would spend if they were to make the same purchase outside of the scheme. Previously, there was a cap of £1,000, meaning cyclists could only acquire starter bikes. However, the government removed this cap, and employees now have a much wider choice of bikes or equipment under the new guidelines, including folding city bikes and electric bikes.

The scheme started to promote the cycling commute, not cycling in general. Your employer technically owns the bike once the 'hire' period is over, but at this stage, you will typically have the option to buy the bike from your employer.

How much can you save using the scheme?

Savings vary per transaction, depending on your tax bracket and the cost of the bike and equipment you buy.

Because the repayments reduce your gross salary, you won't be charged tax and National Insurance contributions that you would usually pay on that chunk of your salary.

For a basic rate taxpayer, this equates to 32 per cent of the bike purchase price. For higher rate taxpayers, you can save up to 42 per cent.

If you have the cost of the bike you want to buy and your gross salary to hand, you can use the Green Commute Initiative's online calculator to work out:

- How much your monthly take-home pay will be reduced by

- Your total savings in cash value

- Your total saving as a percentage

Because the scheme reduces your gross salary, it's worth discussing some finer details with your employer, including the impact it may - or may not - have on your statutory sick pay or your pension pot.

How to purchase your tax-free bike

Each cycle scheme will have a unique application process. They are fairly straightforward and will typically look something like this:

- Find the scheme your employer is enrolled in

- Do some window shopping and decide on your budget

- Have your employer review your application

- Request a certificate from your HR department

- Take your certificate to the relevant provider in exchange for your bike and equipment

- Salary sacrifice beings from your next paycheck

Are you ready to apply?

If you have been instructed to start your application directly through the scheme, you will need:

- Your employer code

- Your payroll number

- An idea of your budget

What happens at the end of the scheme’s ‘hire’ period

As we briefly mentioned, you will be 'hiring' the bike for the length of your agreement. Although many people choose to purchase the bike from their employer at the end of the term, there are a few options:

- Start a new agreement to rehire the bike

- Purchase the bike from the scheme

- Return the bike

New agreements can run for different lengths of time depending on the scheme you are signed up to. Typically, the usage of your bike will be up to four or five years.

HMRC rules state that to buy the bike at the end of the term, you will have to make a one-off payment to the provider. This fee is based on how long you have been using the bike and its initial value.

Below are the minimum values that HMRC places on used bikes for different ages:

|

Age of Bike |

Initial Value - £500 |

Initial Value + £500 |

|

12 months |

18% |

25 % |

|

18 months |

16% |

21% |

|

2 years |

13% |

17% |

|

3 years |

8% |

12% |

|

4 years |

3% |

7% |

|

6 years or over |

0% |

0% |

For purchases with the Cycle Scheme, you can pay a small refundable deposit at the end of your hire period, letting you keep the bike for a further three years. After these three years, the bike becomes yours at no extra cost. You can also change jobs and enrol in a new scheme during this time.

What happens if you leave your job during the hire period?

People leave jobs for many reasons, it's a part of life. But what happens if this occurs during your hire period?

If you want to keep the commuter bike, you will need to pay off the remaining balance, and sometimes the employer might charge the depreciated value of the bike and or accessories, too. Sometimes, your employer might decide they want to keep the bike, or you might want to return it anyway.

If you do decide to keep the bike and come to an agreement with your employer, you will repay the remaining balance from your final net salary without the tax and National Insurance savings.

Do you qualify for a Cycle to Work scheme?

As long as your employer has registered to a Cycle to Work provider, any employee over the age of 18 is entitled to apply.

Employers have been recognising the environmental and employee benefits of cycling to work for many years, but this is even more prevalent following the pandemic. So, there is a high chance your employer will be registered, especially in cities such as London.

If you are self-employed, don't worry - there is still a way!

You can use a scheme if your business is set up in a way that you are technically employed by your own limited company. If not, you can purchase a bike and claim the VAT back through the business.

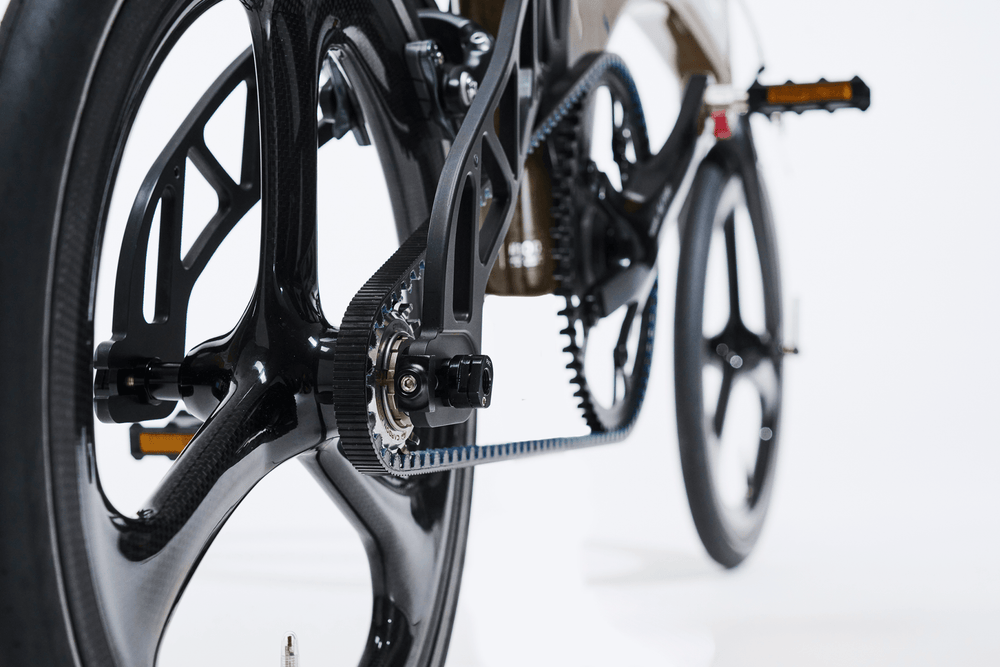

Hummingbird is proudly registered with Cycle Scheme, one of the UK’s leading Cycle to Work schemes. The scheme allows you to purchase Hummingbird’s lightweight folding bikes and cycling accessories, making unbeatable savings through a tax break.

Owing to changes in the scheme, this also includes our Hummingbird folding electric bike!

Get in touch with us if you are eager to find out more.

Prodrive Folding

Electric Bike

The ultimate city bike is here.

Latest from

the magazine